All Categories

Featured

Table of Contents

- – World-Class Accredited Investor Crowdfunding O...

- – Expert Accredited Investor Wealth-building Opp...

- – Favored Accredited Investor Real Estate Deals

- – Innovative Accredited Investor Passive Income...

- – Market-Leading Accredited Investor Investmen...

- – Groundbreaking Exclusive Investment Platform...

- – First-Class Real Estate Investments For Accr...

The laws for certified investors vary among jurisdictions. In the U.S, the meaning of an accredited financier is placed forth by the SEC in Policy 501 of Guideline D. To be a recognized capitalist, an individual has to have a yearly income going beyond $200,000 ($300,000 for joint income) for the last two years with the expectation of making the exact same or a higher revenue in the current year.

This quantity can not include a primary home., executive police officers, or supervisors of a company that is providing non listed protections.

World-Class Accredited Investor Crowdfunding Opportunities

Also, if an entity is composed of equity proprietors who are recognized capitalists, the entity itself is a recognized capitalist. However, an organization can not be developed with the single purpose of acquiring specific safeties - accredited investor alternative asset investments. An individual can qualify as a recognized financier by demonstrating adequate education or task experience in the monetary industry

People who intend to be accredited financiers do not use to the SEC for the classification. Rather, it is the duty of the firm providing an exclusive placement to make certain that every one of those come close to are accredited capitalists. People or events who wish to be recognized investors can approach the provider of the non listed protections.

For example, suppose there is an individual whose income was $150,000 for the last three years. They reported a main house value of $1 million (with a home loan of $200,000), an auto worth $100,000 (with a superior lending of $50,000), a 401(k) account with $500,000, and an interest-bearing account with $450,000.

This individual's net well worth is specifically $1 million. Considering that they satisfy the net worth demand, they qualify to be an accredited financier.

Expert Accredited Investor Wealth-building Opportunities with Accredited Investor Support

There are a couple of much less typical credentials, such as handling a trust with greater than $5 million in assets. Under government securities legislations, only those that are recognized investors might take part in particular safeties offerings. These may consist of shares in exclusive placements, structured items, and exclusive equity or hedge funds, to name a few.

The regulators desire to be particular that individuals in these highly dangerous and intricate financial investments can look after themselves and judge the risks in the lack of government protection. The recognized capitalist guidelines are created to protect potential capitalists with restricted monetary understanding from risky ventures and losses they might be ill furnished to stand up to.

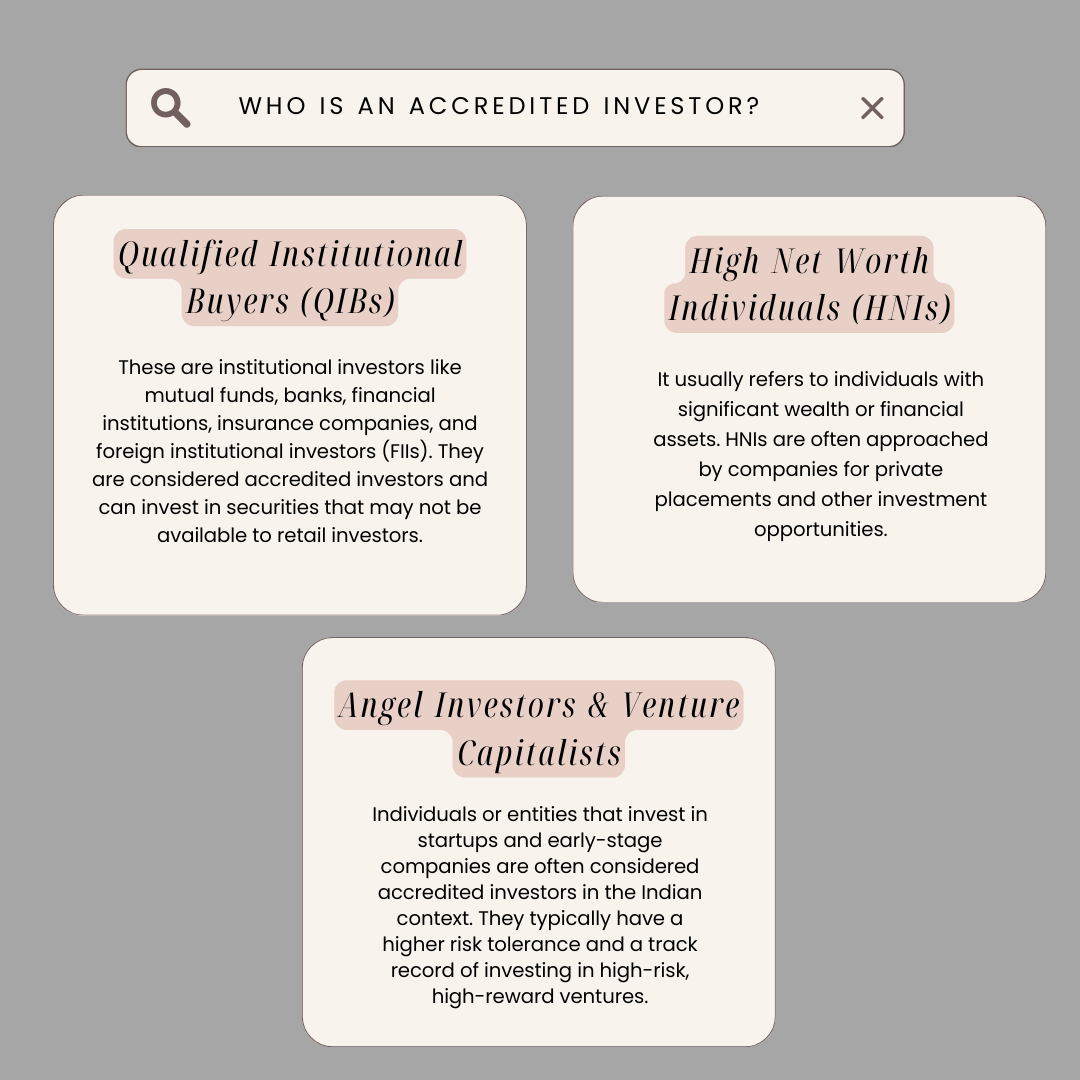

Approved capitalists meet certifications and professional standards to accessibility special investment possibilities. Designated by the United State Stocks and Exchange Payment (SEC), they gain entry to high-return alternatives such as hedge funds, endeavor capital, and exclusive equity. These financial investments bypass full SEC registration however bring higher threats. Accredited financiers must fulfill income and total assets needs, unlike non-accredited people, and can spend without constraints.

Favored Accredited Investor Real Estate Deals

Some crucial modifications made in 2020 by the SEC include:. This adjustment acknowledges that these entity kinds are often made use of for making investments.

These amendments broaden the accredited capitalist pool by roughly 64 million Americans. This larger gain access to gives a lot more chances for investors, but additionally raises possible risks as less financially sophisticated, capitalists can participate.

These investment alternatives are special to accredited capitalists and organizations that certify as a recognized, per SEC regulations. This offers certified investors the chance to spend in emerging companies at a phase prior to they consider going public.

Innovative Accredited Investor Passive Income Programs

They are checked out as financial investments and are accessible only, to qualified customers. In addition to known companies, qualified financiers can pick to buy startups and promising ventures. This supplies them income tax return and the possibility to go into at an earlier stage and potentially enjoy incentives if the company succeeds.

Nevertheless, for capitalists open to the dangers entailed, backing start-ups can lead to gains. A number of today's tech companies such as Facebook, Uber and Airbnb came from as early-stage startups sustained by accredited angel investors. Sophisticated financiers have the chance to discover investment alternatives that might produce extra revenues than what public markets use

Market-Leading Accredited Investor Investment Opportunities

Although returns are not guaranteed, diversification and profile enhancement alternatives are expanded for financiers. By expanding their portfolios through these expanded investment methods approved investors can improve their approaches and potentially attain exceptional lasting returns with appropriate threat monitoring. Experienced investors commonly encounter investment choices that may not be quickly available to the basic capitalist.

Financial investment alternatives and safeties supplied to approved financiers typically include greater dangers. Personal equity, venture resources and hedge funds usually concentrate on spending in possessions that carry danger but can be liquidated easily for the opportunity of higher returns on those risky investments. Investigating before spending is important these in situations.

Lock up periods stop investors from taking out funds for more months and years on end. There is likewise much much less openness and governing oversight of exclusive funds compared to public markets. Capitalists might have a hard time to properly value exclusive possessions. When taking care of threats certified capitalists require to assess any type of personal investments and the fund supervisors involved.

Groundbreaking Exclusive Investment Platforms For Accredited Investors

This adjustment may expand certified financier condition to a series of individuals. Upgrading the earnings and property benchmarks for rising cost of living to ensure they mirror changes as time proceeds. The present limits have remained static considering that 1982. Allowing partners in committed relationships to integrate their resources for shared eligibility as certified investors.

Making it possible for individuals with specific expert accreditations, such as Series 7 or CFA, to certify as certified investors. This would certainly acknowledge financial sophistication. Creating additional needs such as evidence of financial proficiency or efficiently completing a certified financier exam. This might ensure capitalists recognize the threats. Limiting or getting rid of the key house from the total assets calculation to reduce possibly inflated assessments of riches.

On the other hand, it might also result in experienced investors assuming extreme dangers that may not be suitable for them. Existing certified capitalists might deal with increased competition for the best investment chances if the pool grows.

First-Class Real Estate Investments For Accredited Investors for High Returns

Those who are presently thought about certified financiers must remain updated on any alterations to the standards and regulations. Companies seeking accredited capitalists need to stay attentive concerning these updates to ensure they are drawing in the right target market of financiers.

Table of Contents

- – World-Class Accredited Investor Crowdfunding O...

- – Expert Accredited Investor Wealth-building Opp...

- – Favored Accredited Investor Real Estate Deals

- – Innovative Accredited Investor Passive Income...

- – Market-Leading Accredited Investor Investmen...

- – Groundbreaking Exclusive Investment Platform...

- – First-Class Real Estate Investments For Accr...

Latest Posts

Delinquent Tax Properties Near Me

Investing Tax Lien

Excess Proceeds

More

Latest Posts

Delinquent Tax Properties Near Me

Investing Tax Lien

Excess Proceeds